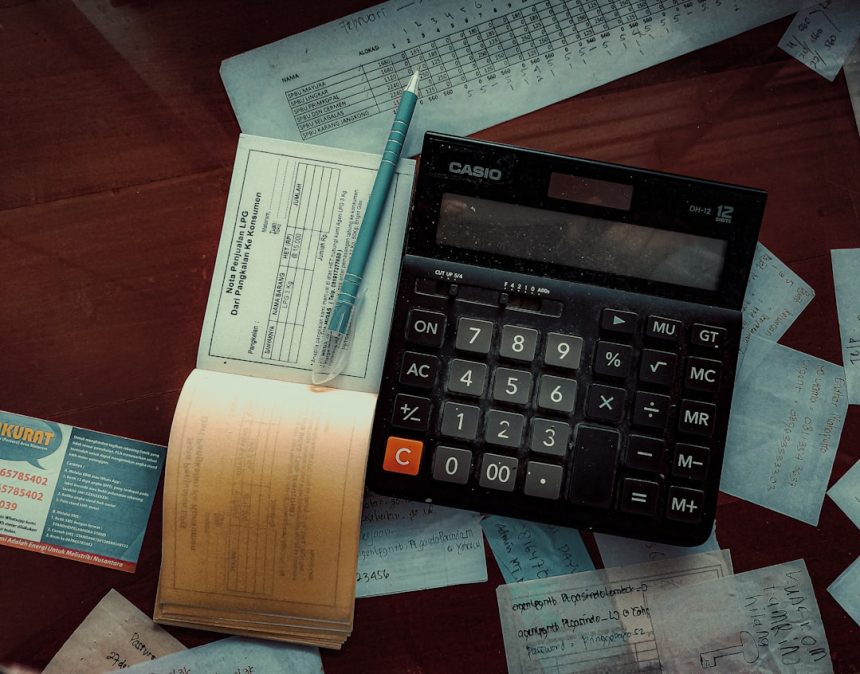

Managing financial data accurately is essential for businesses, accountants, and anyone who wants to maintain proper financial records. For many, bank statements arrive in OFX (Open Financial Exchange) format, a popular file type for financial data. However, importing these files into Microsoft Excel can be a challenging and error-prone process without the right tools. That’s where an Excel Add-In for OFX files becomes invaluable. With the right add-in, you can streamline your workflow and import bank data quickly and reliably.

What is an OFX File?

OFX is a standard data format used by banks and financial institutions to exchange financial information electronically. The format is used widely in online banking and accounting systems and typically contains transaction details, account balances, and other related financial information. Although it is a standard format, it is not natively supported by Excel in a plug-and-play manner.

[ai-img]ofx file, excel spreadsheet, financial data import[/ai-img]

Without the appropriate tools or technical skills, parsing OFX files into a readable and usable format inside Excel can become time-consuming and technically complex.

Why Use an Excel Add-In for OFX Files?

An Excel Add-In specifically designed to handle OFX files simplifies the entire process. It offers a range of benefits, including:

- Compatibility – Easily open and convert OFX files without the need for manual coding or third-party converters.

- Time Savings – Automate the import process to handle large volumes of transactions instantly.

- Reduced Errors – Minimize errors common in manual copy-paste methods or inefficient parsing scripts.

- Enhanced Reporting – Use Excel’s native power to analyze and report on your bank data once imported.

Key Features to Look For in a Quality Excel OFX Add-In

If you’re considering integrating an add-in to import OFX files into Excel, ensure it includes some or all of the following features:

- Direct Import Capability: Ability to import the file directly into Excel without data corruption.

- Customizable Mapping: Options to select specific data fields such as date, payee, memo, and amount.

- Date Range Filtering: Useful for selecting only relevant transactions for your reports.

- Multi-currency Support: Especially important for businesses dealing in international transactions.

- Batch Processing: Ability to import multiple OFX files simultaneously.

[ai-img]excel add in, bank import tool, ofx file automation[/ai-img]

How to Use an Excel Add-In to Import OFX Files

Most OFX import add-ins for Excel are designed with usability in mind, offering simple interfaces for users of all technical levels. Generally, the process follows a few basic steps:

- Install the Excel Add-In from a trusted source, ensuring it supports your Excel version.

- Open Excel and launch the Add-In from the toolbar or menu.

- Browse your local files to select the OFX file you want to import.

- Select the target worksheet or let the Add-In create a new one.

- Map the fields, or use the auto-map feature if available.

- Click “Import” and let the tool populate your Excel sheet with bank data.

Once complete, your transaction history, balances, and other relevant details will appear neatly organized in Excel, ready for reconciliation or further analysis.

Some tools even allow ongoing synchronization with your bank feed, updating the spreadsheet automatically as new transactions become available.

Security and Privacy Considerations

When dealing with financial data, security is paramount. Ensure the add-in you choose is from a reputable developer and offers adequate security controls. Features to verify include:

- Data encryption during import and storage.

- No cloud dependency unless explicitly required and protected.

- Ability to work fully offline for sensitive information.

Additionally, review any user agreements and data handling practices to ensure compliance with your organizational or regulatory standards.

Conclusion

Financial management becomes much easier when leveraging the right tools. An Excel Add-In for OFX files can save time, reduce errors, and provide a professional level of control over financial data. Whether you’re an individual managing multiple bank accounts or a finance team responsible for detailed reporting, utilizing a robust OFX import tool will dramatically improve your workflow.

As financial data grows in complexity, tools that make financial management simpler, safer, and more efficient become not just helpful—but essential.